link and learn taxes on irs.gov

This lesson will provide links to resource materials and practice which covers tax credits that help taxpayers offset the costs of higher education by reducing the amount of their tax liability. Getting Started 5 Open your Form 13615 as a PDF by clicking Click here to open and complete your Volunteer Agreement.

How Much Can A Retired Person Earn Without Paying Taxes As Usa

IRS Courseware - Link Learn Taxes Education Benefits American opportunity credit for 2021 is gradually reduced phased out if taxpayers MAGI is between 80000 and 90000 160000.

. Set up a new IRS account. The online test grades the test automatically and provides a helpful explanation for. Sign in to your IRS account.

Information for tax professionals. Who Can Claim the Deduction. It is a great resource for high schools community colleges and the general public for learning more about the history theory and application of taxes in the United States.

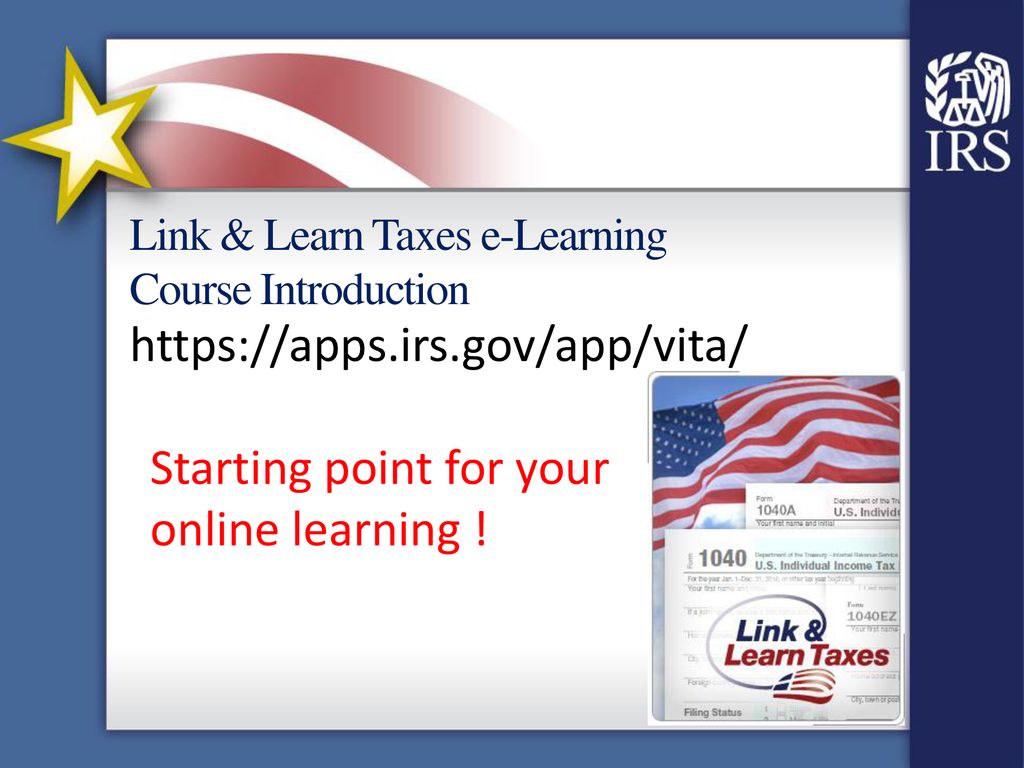

Getting Started Job Aid - IRS tax forms. Link Learn Taxes is self-paced e-learning for the Volunteer Income Tax Assistance and Tax Counseling for the Elderly VITATCE program. Set up a new IRS account.

Ethan obtained a qualified student loan to attend college. Sign in to your IRS account. Publication 4012 Volunteer Resource Guide Form.

Link Learn Taxes Certification Tests. After graduating from college the first monthly payment on his loan was due in. 2On the home page go to Additional Resources and click the link for the Tax Software Practice Lab.

Your browser appears to have cookies disabled. This training provides links to resource materials and practice to introduce you to the major components of the VITATCE return preparation process and demonstrate how they contribute. Link Learn Taxes Certification Tests.

To be eligible for a full or partial credit the taxpayer must have earned income of at least 1 but less than. Link and Learn testing is the preferred method to certify because it will automatically score the test. The preferred method of training and certification is through Link Learn Taxes on IRSgov.

51464 57414 if Married Filing Jointly with three or more qualifying children. IRS Courseware - Link Learn Taxes Course Introduction Workout Getting started In addition to Publication 4491 volunteers will also need. All completed and.

Go to Link and Learn Taxes on. Cookies are required to use this site. Publication 4491 Student Training Guide electronic only PDF is.

Access online tools for tax professionals register for or renew your Preparer Tax Identification Number PTIN apply for an Electronic. If you cannot enable JavaScript on your computer request a printed. Getting Started 5 Taking VITATCE Certification Tests Volunteers preparing tax returns must pass either the Basic or Advanced certification test.

To receive the full benefits of the e-learning interactivity in this course you must have JavaScript enabled on your computer.

Irs Courseware Link Learn Taxes

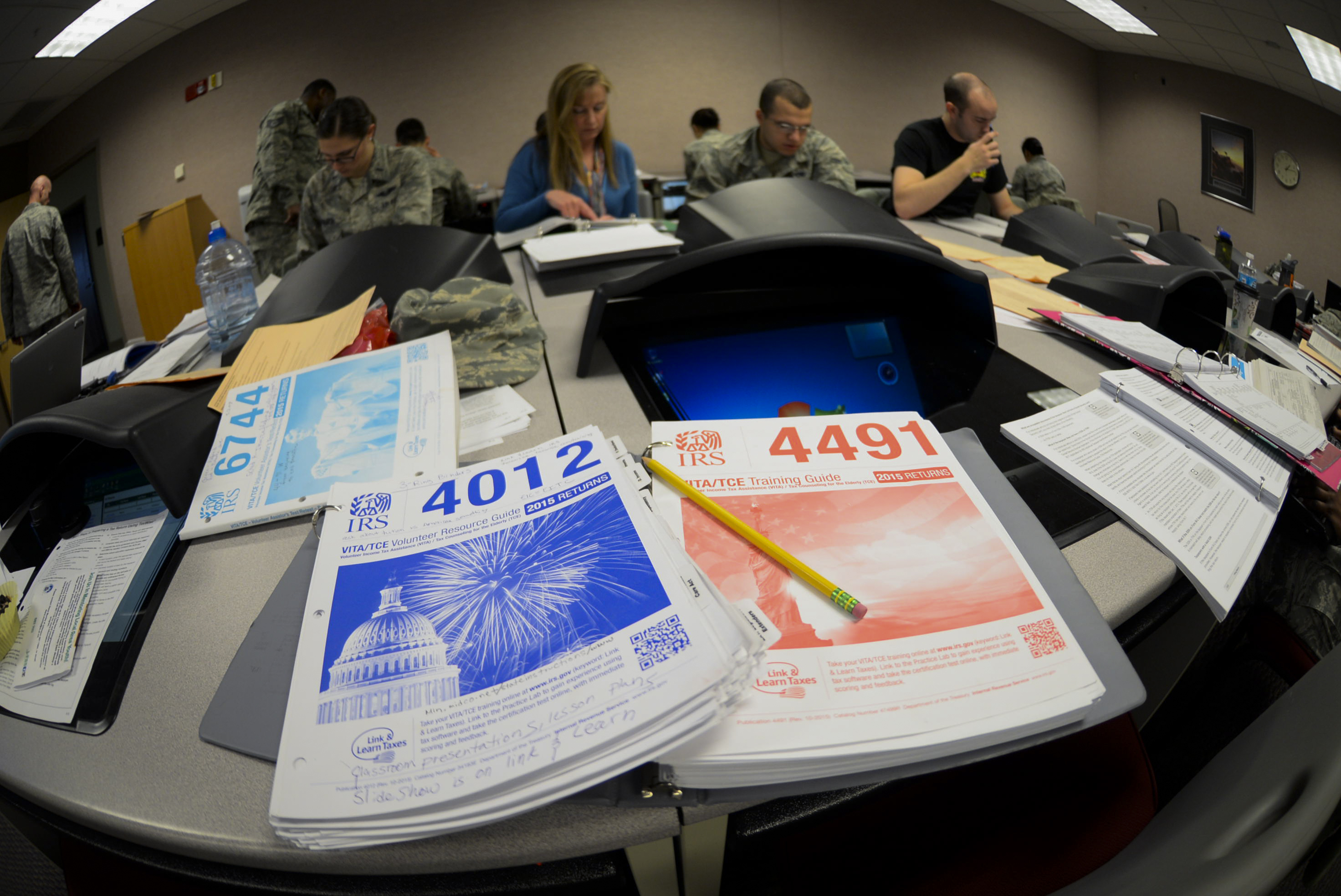

Tax Season Approaches Whiteman Air Force Base News

Link Learn Taxes Linking Volunteers To Quality E Learning

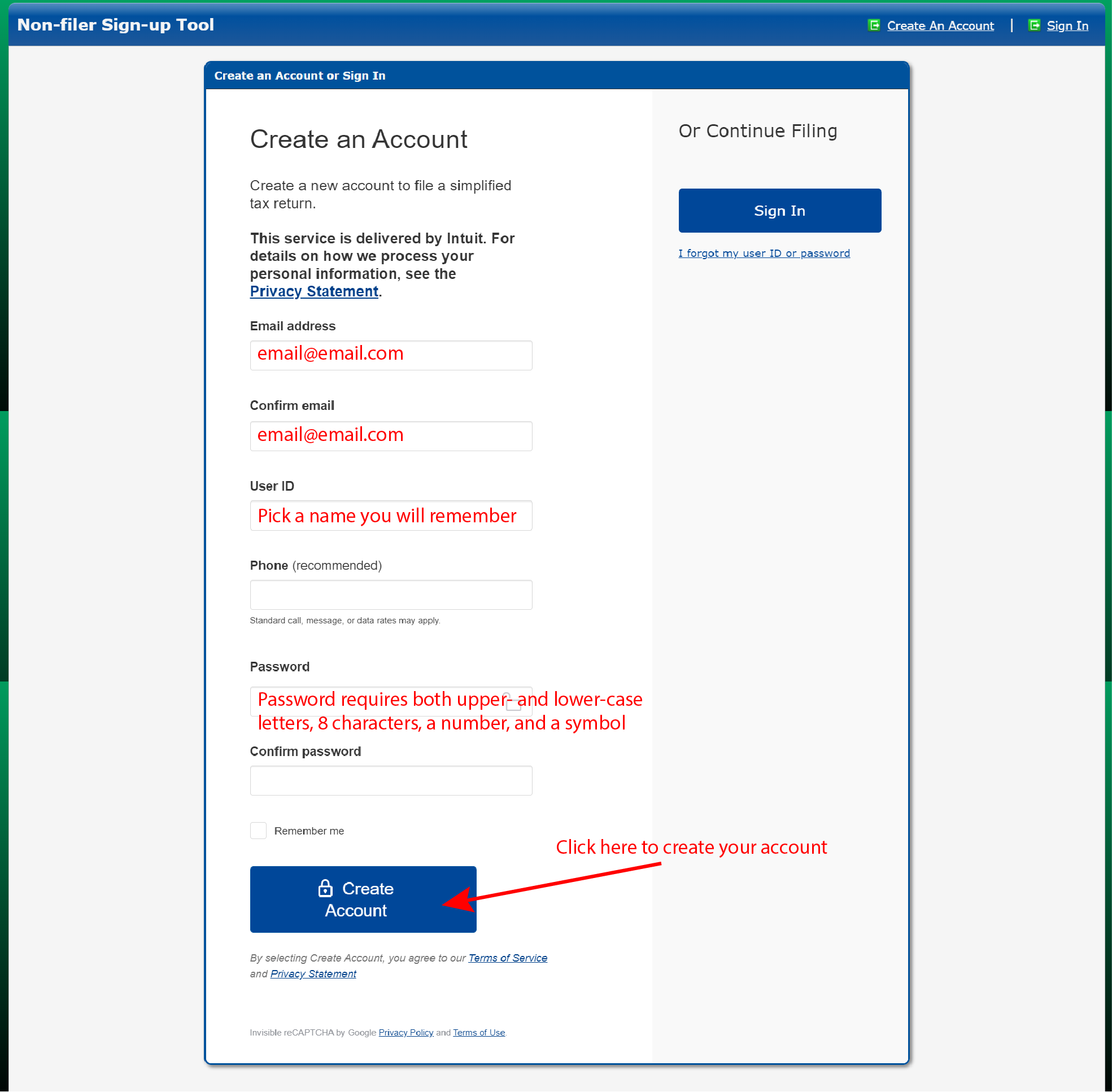

How To Fill Out The Irs Non Filer Form Get It Back

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Nu Offering Tax Assistance To Falls Residents Local News Niagara Gazette Com

Internal Revenue Service An Official Website Of The United States Government

Getting Started With Taxslayer Practice Lab

Irs Courseware Link Learn Taxes

Internal Revenue Service An Official Website Of The United States Government

Introducing Tax Pro Account Youtube

Introduction To Vita Federal Tax Law Tax Year Ppt Download

Irs Courseware Link Learn Taxes

Irs Courseware Link Learn Taxes

Irs Courseware Link Learn Taxes

Free Online Tax Filing E File Tax Prep H R Block

Irs Courseware Link Learn Taxes

Solved Use Https Www Irs Gov Pub Irs Pdf F6744 Pdf If Chegg Com